Your options

There are two investment strategies available and you choose which one suits you best. You then choose the funds you’d like your contributions to be invested in, within that strategy.

How it works

LifePlan is designed with the aim of managing investment risks as you approach retirement. It aims to 'grow' your account in the early-to-mid stages of saving for your retirement by investing in growth funds. As you approach your target retirement age, the investment of your account will automatically 'switch' from your LifePlan growth fund(s) to more stable, less risky approaching retirement fund(s), which aim to reduce the risk that the value of your account will significantly fall in value. This move takes place gradually, month-by-month, over either 5, 10 or 15 years, depending on what you choose.

If you don’t retire at your target retirement age your account will remain invested in your approaching retirement fund(s) until you choose to take your benefits.

You can set up a different LifePlan strategy for each of your contribution types. For example, you can choose to have core contributions invested in one growth fund and company contributions invested in another.

You can take some of your account as a tax-free cash lump sum. If you intend to do this, some of the money in your growth fund will gradually move into Destination Cash (see ‘LifePlan funds’) during your switching period.

Why choose LifePlan?

LifePlan helps take the time and effort out of managing your investments because your account automatically switches to funds exposed to less risk as you approach retirement.

Who is this suitable for?

LifePlan may be suitable for you if you’re uncomfortable managing your investments or don’t have the time to regularly monitor investment performance. LifePlan invests your account on the basis that you plan to take your benefits at your target retirement age. You can choose to take your benefits earlier or later than this, but if you choose to do so you should check that your account is invested appropriately.

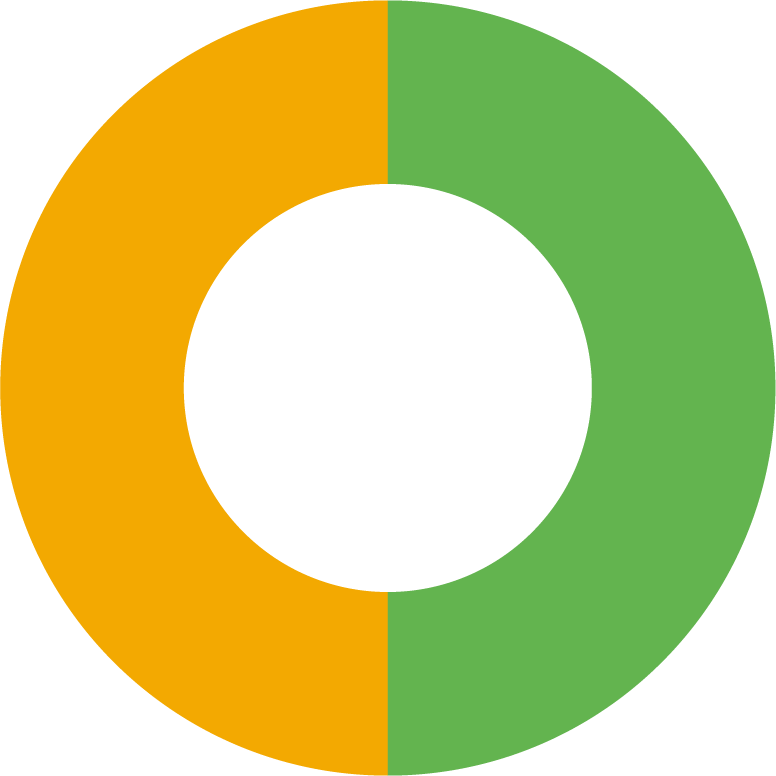

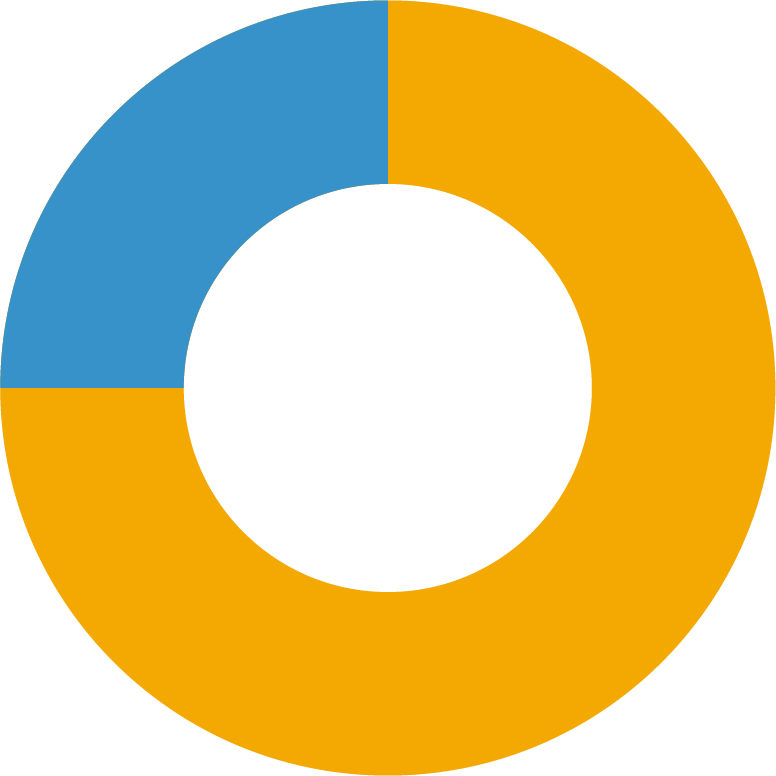

The following shows how your account will switch from growth funds to approaching retirement funds as you approach retirement. In this example we have assumed that some of your account will be taken as a tax-free cash lump sum.

Your account

More than 10 years from retirement Less than 10 years from retirement

Less than 10 years from retirement

At retirement

At retirement

How it works

PersonalChoice offers you a range of 14 different funds to choose from. Unlike LifePlan, your funds will not automatically switch to less risky investments as you approach retirement – you choose the funds you’re invested in right up until the point you retire – which means you have more control over how your contributions are invested.

Why choose PersonalChoice?

PersonalChoice gives you a wider range of funds than LifePlan, giving you more control over how and where your contributions are invested. It allows you to choose from any number and combination of the 14 funds available and how you want to split your contributions. This approach is suited to more confident and knowledgeable investors and could potentially result in higher investment returns, but you should also be aware of the investment risks involved and seek independent financial advice if you’re unsure.

Who is this suitable for?

If you want to take a more active interest in where your contributions are invested, PersonalChoice may be the investment strategy for you. If you’re not sure when you want to retire, PersonalChoice may be the right approach as it doesn’t work on the basis that you will take your benefits at your target retirement date.

If you decide to invest in PersonalChoice, it's important that you monitor your investments regularly to make sure they're still meeting your needs.

How it works

Unless you choose otherwise, your contributions will automatically be invested in a specific version of LifePlan, chosen by the Trustee. It will continue to apply to you throughout your membership unless you make your own investment choice:

| Growth fund | Approaching retirement fund | Target retirement age | Switching period |

| Your Journey Extra | Your Destination (Increasing Income) | 60 | 10 years, or the time left until target retirement age, if shorter. |

You can choose to take some of your account as tax-free cash at retirement and this version of LifePlan assumes you will, so some of the money in your growth fund will gradually move into Destination Cash during your switching period. This fund invests in a range of cash and cash-like investments and aims to provide stability by giving a low-volatility return.

What is the objective of LifePlan?

LifePlan is designed with the aim of managing investment risks as you approach retirement. It aims to ‘grow’ your account in the early-to-mid stages of saving for your retirement by investing in growth funds. As you approach your target retirement age, the investment of your account will automatically ‘switch’ from your LifePlan growth fund(s) to more stable, less risky approaching retirement fund(s), which aim to reduce the risk that the value of your account will significantly fall in value. This move takes place gradually, month-by-month, over 10 years in the run-up to your target retirement date.

Who is this suitable for?

The Trustee believes that this version of LifePlan is suitable for most members, based on expected retirement choices and appetite for risk, which is why this approach applies if you do not make your own investment choice. However, it might not be right for everyone so the Trustee strongly recommends that you check it’s right for you and seek independent financial advice if you are unsure.

Changing your investment choices

You can change your investment strategy, investment funds and target retirement date at any time on Your Pension.